For many of our neighbours in communities like Kitchener, Waterloo, and Stratford, the first frost isn’t just a sign of winter—it’s the signal to pack the bags and head south. Whether you’re a seasoned snowbird or planning your first extended winter stay, protecting your health and your hard-earned retirement is essential.

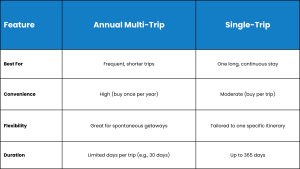

At Strong Roots Insurance, we believe in building a solid foundation for your protection. Choosing the right travel insurance shouldn’t be a source of stress; it should provide you with profound peace of mind. One of the most common questions we hear is: “Should I get an annual multi-trip plan or a single-trip policy?”

Here is our expert guide to finding reliable solutions that fit your lifestyle.

Annual Multi-Trip Plans: For the Spontaneous Traveller

An annual multi-trip plan is designed for frequent travellers who cross the border more than once or twice a year.

- How it Works: You pay one flat rate for coverage that lasts 365 days. It covers an unlimited number of trips, provided each individual trip stays under a certain duration (typically 15 or 30 days).

- The Pros:

- Convenience: You only need to set it up once a year. If you decide on a last-minute weekend trip to catch a game in Michigan or visit family in another province, you’re already covered.

- Cost-Effective: If you travel three or more times annually, this often works out to be much cheaper than buying individual policies.

- The Cons:

- Duration Limits: If your winter stay in Florida lasts 90 days but your annual plan only allows for 30-day “stints,” you’ll need to purchase a “top-up” for the extra days.

Single-Trip Policies: For the Long-Stay Snowbird

If you prefer to “fly south” once and stay there until the spring thaw in London or St. Marys, a single-trip policy is likely your best bet.

- How it Works: This policy is tailored to you and your specific dates. It covers one continuous journey from the day you leave your home province until the day you return.

- The Pros:

- Extended Travel: These policies can often cover stays up to 183 or even 365 days, making them ideal for high-value, long-term winter residences.

- No Gaps: You are covered for the entire duration without needing to track “trip days” or manage top-ups.

- The Cons:

- One-and-Done: Once you return home, the policy ends. If you decide to take another trip later in the year, you’ll have to go through the application process again.

Which One Provides the Best Foundation?

Choosing the right plan depends on your unique needs. As your local partners, we focus on simplifying insurance so you can focus on the sunshine.

Expert Advice for Your Next Adventure

Don’t settle for a “one-size-fits-all” statement from a big-city brokerage. We are committed to finding the “no gimmick” solutions that protect what matters most: your health and your future.

We live here, we work here, and we understand the nuances of protecting our community. Before you head out on your next long stay, let’s chat about your plans to ensure your coverage is as strong as your roots.